The European Union is taking further steps to implement its strategy on sustainable finance through bonds and the transition to a climate-neutral, resource-efficient economy, the EU said.

Negotiators of the Council and the European Parliament reached a provisional agreement on the creation of European green bonds (EuGB).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataElisabeth Svantesson, Minister for Finance of Sweden, said: “The new standard which we are setting will be useful for both issuers and investors of green bonds. Issuers will be able to demonstrate that they are funding legitimate green projects aligned with the EU taxonomy. And investors buying the bonds will be able to more easily assess, compare and trust that their investments are sustainable, thereby reducing the risks posed by greenwashing.”

This regulation lays down uniform requirements for issuers of bonds that wish to use the designation ‘European green bond’ or ‘EuGB’ for their environmentally sustainable bonds that are aligned with the EU taxonomy and made available to investors globally.

It also establishes a registration system and supervisory framework for external reviewers of European green bonds. To prevent greenwashing in the green bonds market in general, the regulation also provides for some voluntary disclosure requirements for other environmentally sustainable bonds and sustainability-linked bonds issued in the EU.

Environmentally sustainable bonds are one of the main instruments for financing investments related to green technologies, energy efficiency and resource efficiency as well as sustainable transport infrastructure and research infrastructure.

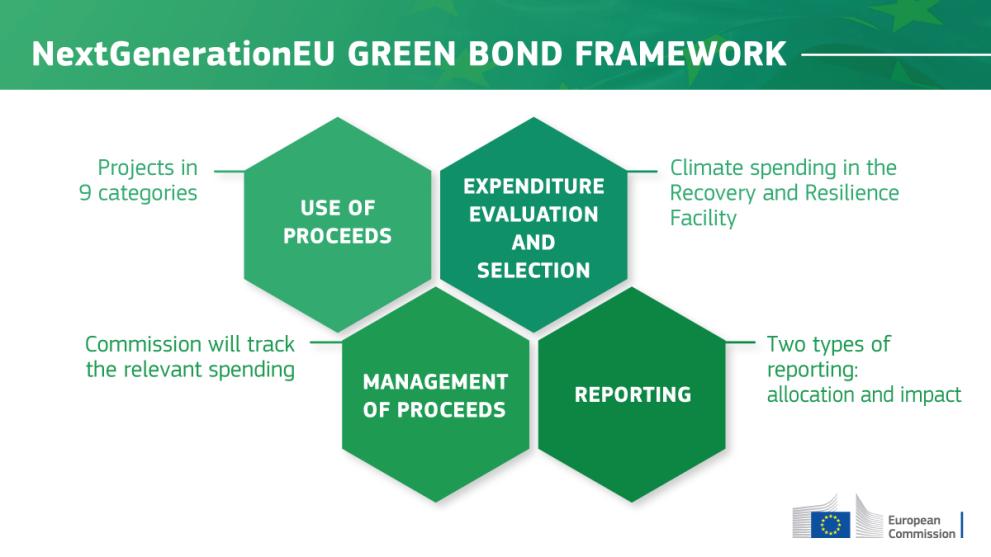

Under the provisional agreement, all proceeds of EuGBs will need to be invested in economic activities that are aligned with the EU taxonomy, provided the sectors concerned are already covered by it.

For those sectors not yet covered by the EU taxonomy and for certain very specific activities there will be a flexibility pocket of 15%. This is to ensure the usability of the European green bond standard from the start of its existence. The use and the need for this flexibility pocket will be re-evaluated as Europe’s transition towards climate neutrality progresses and with the ever-increasing number of attractive and green investment opportunities that are expected to become available in the coming years.

As regards supervision, the national competent authorities of the home member state designated (in line with the Prospectus Regulation) shall supervise that issuers comply with their obligations under the new standard.

The agreement is provisional as it still needs to be confirmed by the Council and the European Parliament, and adopted by both institutions before it is final. It will start applying 12 months after its entry into force.

Also see: Get your nominations in for the Sustainable Finance Awards 2023!