The latest data from the Insolvency Service paints a concerning picture for UK businesses.

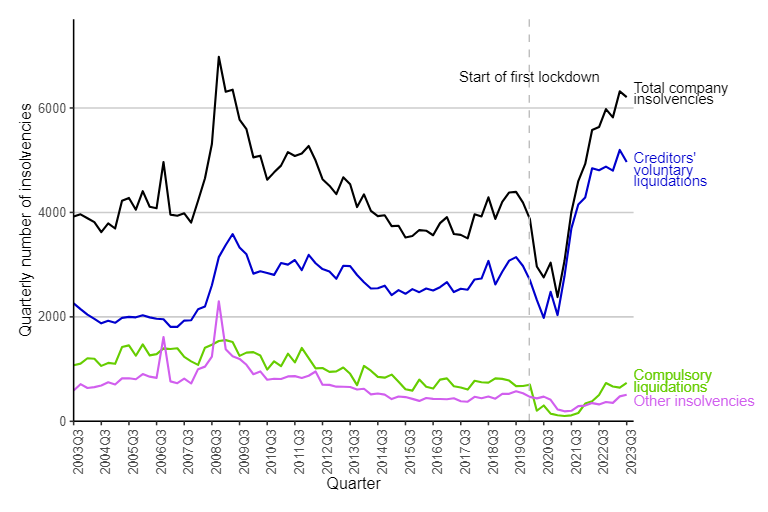

The last two quarters of 2023 saw insolvency figures at their highest since 2009, with record numbers of creditors’ voluntary liquidations (CVLs) dating back to 1960. In the period from July to September 2023, there were 6,208 registered company insolvencies, according to the Service, an executive agency sponsored by the Department for Business, Energy and Industrial Strategy (BEIS).

While there was a 2% decrease from the previous quarter, it marked a substantial 10% increase compared to the same period in 2022. Of these, 4,965 insolvencies were CVLs, 732 were compulsory liquidations, and 466 were administrations. Between October 2022 and September 2023, one out of every 191 active companies underwent insolvent liquidation.

Insolvencies in England and Wales, Q3 2003 to Q3 2023, seasonally adjusted:

These alarming statistics are attributed to complex economic trends. The combination of a cost-of-living crisis and higher borrowing costs has led to decreased disposable income, reduced consumer confidence, and consequently, lower levels of spending.

Julie Palmer of Begbies Traynor emphasised the situation, stating that businesses burdened with debt acquired at historically low rates, which relied on government support during the pandemic, are now grappling with the financial reality of higher interest rates impacting working capital for the foreseeable future.

It’s worth noting that critical financial distress currently affects around 38,000 companies in the UK, as reported by Begbies Traynor.

The construction sector is one of the hardest-hit industries. A study by Begbies Traynor revealed a 46% increase in the number of construction companies facing significant financial difficulties during the three-month period ending in September.

A total of 5,919 construction firms are now in distress, according to Bloomberg’s data. These challenges underscore the importance of vigilance and strategic planning in the financial services sector to navigate the uncertain economic landscape.

Jonathan Andrew, Global CEO of Bibby Financial Services said: “Today’s insolvency figures clearly indicate that the combination of high interest rates, inflation and market uncertainty is undoubtedly beginning to bite. The cost-of-doing-business crisis is a very real threat to the UK’s economic recovery and, in particular, the UK’s SME community.

“The construction, hospitality and retail sectors have been the first to feel the pinch, but the full picture of SMEs’ viability will become clearer after Christmas. By then, we could be staring down the barrel of a gun for insolvencies. Without further support from both the private and public sectors, it’s possible we could see insolvencies exceed the last financial crisis.”

UK businesses hold £176bn in bank accounts offering zero interest