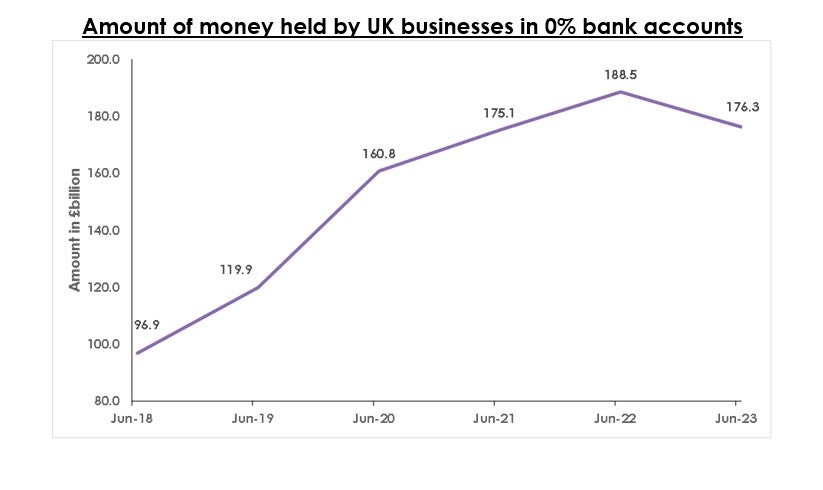

UK businesses are still holding £176 billion in bank accounts that offer zero interest despite rising interest rates and high inflation eating away at the value of their cash, says the wealth management firm Lubbock Fine Wealth Management (LFWM).

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The £176 billion being held in zero-interest accounts (as of July 31, 2023) has risen by 80% from the £98.9 billion that was kept in zero-interest accounts just five years ago.

The Bank of England has repeatedly increased the base rate from 0.1% in the last quarter of 2021 to 5.25% today, its highest level since the 2008 financial crisis. That’s led an increasing number of banks to offer business accounts with substantial rates of interest such as Shawbrook which offers businesses 4.9% on their savings.

Businesses are being urged to consider moving their money into interest-earning accounts as soon as possible to benefit from the opportunity to earn passive income. Andrew Tricker, Director at LFWM, highlights that with inflation (CPI) still standing at 6.7%, the real value of savings kept in zero and low-interest accounts is rapidly falling.

Andrew Tricker says: “So long as inflation and interest rates remain high, businesses are losing out significantly by keeping large deposits in zero-interest accounts.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Whilst cash accounts never really beat inflation, interest rates are now so high that it is essential to shop around for a better deal on a business bank account to at least keep some pace with inflation.”

“Many businesses have got used to a decade and a half where interest rates were effectively zero, when there was little incentive for a company, without a treasury department, to look for a higher rate on business bank accounts. Those days are now over.

“Businesses need to be aware that the value of money being held in a zero-interest account is being eroded at an alarming rate. With inflation at its current level, they are losing over 6p in value from every pound over a single year. By moving their deposits into business accounts that offer interest, some of this loss can at least be mitigated.”