Fitch Ratings has released a new report forecasting sound profitability for Europe’s largest banks in 2024, with only minor weakening attributed to moderately higher loan impairment charges (LICs) and increased costs.

According to Fitch‘s latest quarterly credit tracker, most of the 20 large banks showcased strong performance throughout 2023, thanks to elevated interest rates and robust asset quality.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

However, towards the end of the year, some banks experienced a plateau or slight decline in net interest margins (NIMs) in the fourth quarter due to slower asset repricing and more expensive deposits. Additionally, LICs saw an uptick in anticipation of potential asset-quality deterioration, particularly within the commercial real estate (CRE) sector.

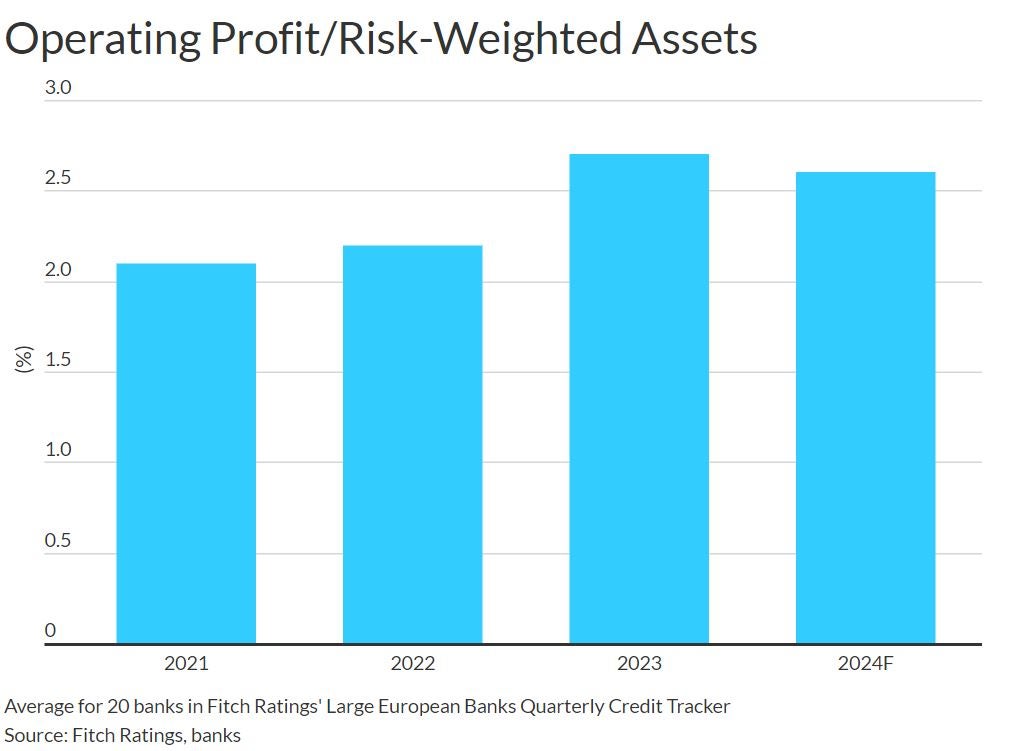

The report projects that the banks’ operating profit to risk-weighted assets ratios will average at 2.6% in 2024, slightly lower than 2023’s 2.7%. This decrease is expected to be mitigated by resilient net interest income (NII), as gradual policy interest rate cuts are anticipated. However, individual profitability trajectories will vary across banks due to differing balance sheet dynamics, deposit pass-through rates, and interest-rate hedging strategies.

Expectations point towards minor declines in deposit margins, particularly in markets dominated by variable-rate loans. Similarly, asset margins are likely to see a slight decrease unless accompanied by increased business volumes and stable interest rates.

French banks faced challenges in 2023, with NIMs dipping below 1% as liabilities repriced faster than assets. Nevertheless, Fitch anticipates a recovery towards long-term averages, with NIMs projected to reach 1.1%–1.2% in 2024. High-single-digit NII increases are expected for French banks, contrasting with flat or slightly lower NII elsewhere.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataModerate asset-quality deterioration is forecasted for 2024, driven by affordability pressures, weak economic growth, and CRE credit losses. On average, the 20 banks have CRE exposure amounting to approximately 75% of common equity Tier 1 capital. However, Fitch believes that these banks should absorb CRE credit losses through earnings, without breaching asset-quality downgrade triggers.

UK life sciences and deep tech thrive under BBB fund