DF Capital, a UK specialist commercial lender and provider of working capital funding, said it has started 2021 “in an enviable position” with “no pandemic related legacy” after a challenging 2020.

The business, which received full authorisation as a bank in September 2020, posted its financial results for full-year 2020.

Carl D’Ammassa (pictured below), chief executive, DF Capital, said: “The impact of the global pandemic made 2020 a challenging year for the Group.”

“However, we start 2021 in an enviable position and on more solid foundations having navigated the impact of Covid-19 well. We have no pandemic related legacy and have protected our lending franchise throughout the year.

“However, we start 2021 in an enviable position and on more solid foundations having navigated the impact of Covid-19 well. We have no pandemic related legacy and have protected our lending franchise throughout the year.

“Receiving full authorisation as a bank will be transformational for the Group’s profitability. We’ve seen strong momentum since authorisation that has continued well into the current year, which gives us confidence in the demand for our products and services as well as the delivery of our strategic plan.

“The Group is currently performing in line with the Board’s expectations. Whilst the economic environment remains uncertain, the strong start in Q1 2021 gives us early confidence in achieving run-rate profitability during Q4 2021,” Carl D’Ammassa said.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe business, based in the North of England, also identified a series of operational and Q1 2021 highlights, as follows:

Operational highlights

Loan book growth was constrained during the year; since receiving the bank licence, momentum was rebuilt, ending up 36% by 31 December 2020 at £113m from a low point of £83m in October 2020.

The loan book was carefully managed through the pandemic achieving results better than periods before Covid-19; on 31 December 2020, arrears represented 0.2% of the loan book.

The Group successfully launched a range of retail savings products, raising over £145m in the 12 weeks to 31 December 2020, which enabled the early repayment of expensive wholesale funding and other debt.

2021 period-end highlights and Q1 trading update

The Group started 2021 entirely funded by retail deposits, which has transformed its net interest margin from less than 2% to approximately 6%.

The loan book has had a strong start to 2021 exceeding £193m on 31 March 2021, up 70% from 31 December 2020.

The loan book has continued to perform well and the arrears trend from the year-end has continued throughout the first quarter of 2021.

The Group has recently launched new 15 and 18 month fixed rate savings products, in addition to a 2 year fixed rate.

The Group completed a £40m fundraise in February 2021 increasing its capital base, providing the necessary funding to support its strategic plan in the short term.

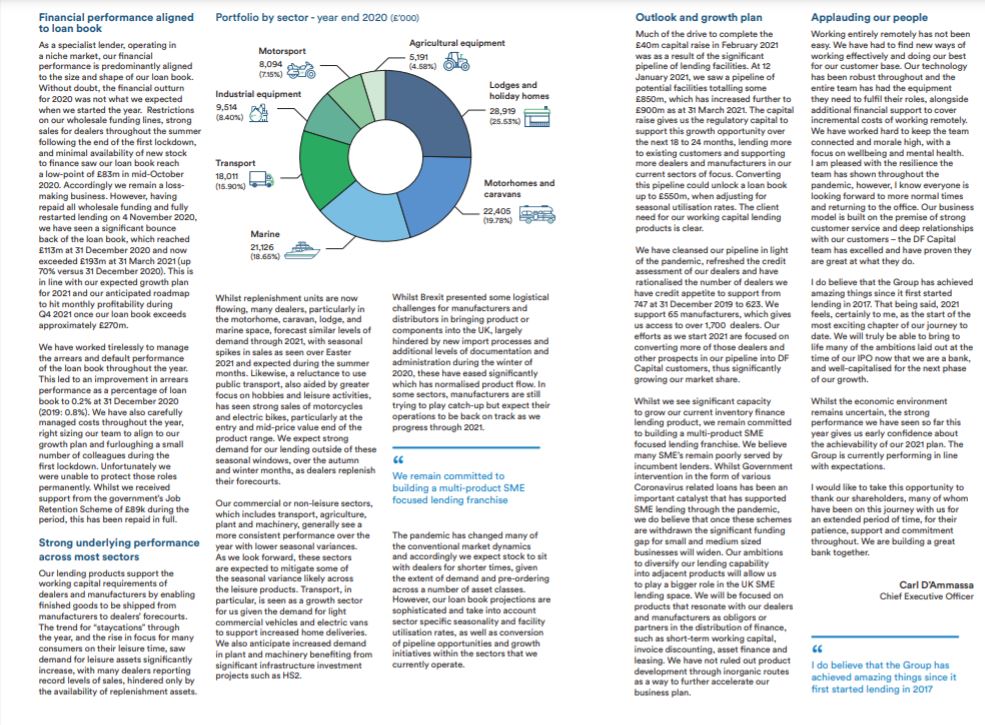

Excerpt from DF Capital annual report 2020 (p8)

Excerpt from DF Capital annual report 2020 (p8)