BankiFi, a fintech provider of payment processing and financial administration services for SMEs, has joined forces with Praetura, a Manchester-based alternative lending firm, to introduce a lending-as-a-service proposition.

This platform aims to enhance SMEs’ access to growth funding, particularly those unable to meet the criteria set by traditional high street banks.

The offering, supported by BankiFi’s technology platform, enables Praetura to deliver asset and invoice finance to SMEs on behalf of banks that may lack the capacity to support such businesses.

As high-street banks have focused primarily on financing larger enterprises, a gap has emerged in recent years in the availability of asset and invoice finance solutions for smaller businesses. Praetura, backed by BankiFi, says it hopes to fill this void by undertaking the risk associated with the initial investment.

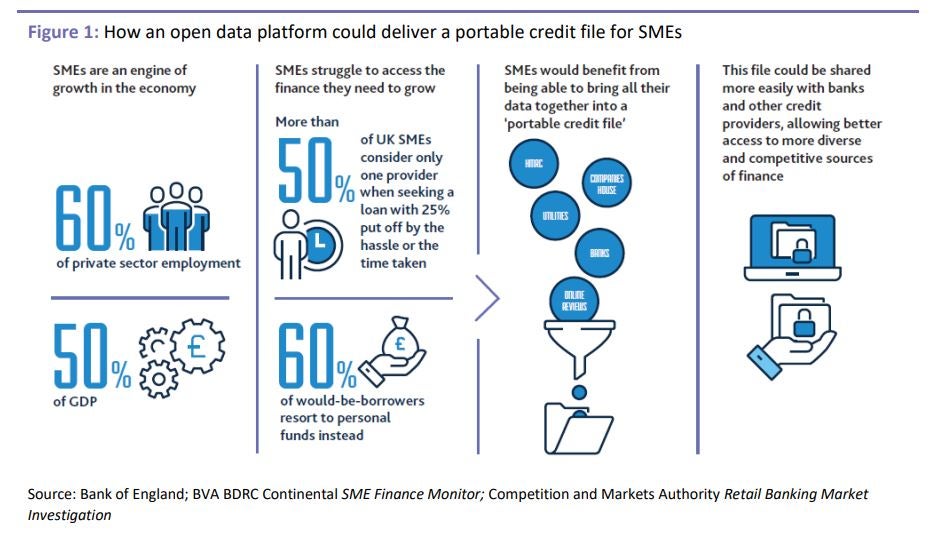

According to the Bank of England, net growth in UK SME lending since 2017 has primarily come from smaller banks and alternative lenders rather than traditional high street banks.

Praetura’s ‘Fund the Gap‘ report, based on a 2023 survey of over 400 UK SMEs, revealed that 59% of businesses felt access to capital had decreased in the last five years, with 43% citing it as a significant challenge.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to a statement from BankiFi and Praetura, the proposal aims to help traditional lenders meet the diverse financing needs of SM|Es, with Praetura absorbing the risk of the initial investment. Banks are positioned as the primary finance providers, ensuring that businesses are referred back to the bank as they grow and become eligible for traditional lending criteria.

Mark Hartley, CEO and founder at BankiFi, highlighted the significance of the partnership, saying: “Our partnership with Praetura is the natural evolution of our existing SME payment solutions, which have focused on reducing the time SMEs spend collecting money and helping them to manage cash flow, growth and now access finance.”

Peadar O’Reilly, CEO at Praetura Lending, said: “This unique partnership signals a new era for SME lending, demonstrating a commitment to innovation, collaboration and meeting the diverse needs of businesses.”

BankiFi, backed by Praetura Ventures since September 2021, has been a leader in revitalising banks’ relationships with SMEs. This collaboration reinforces BankiFi’s dedication to providing innovative solutions that align with the demands of SMEs.