Research published by Bibby Financial Services (BFS) has revealed the extent to which UK small and medium-sized enterprises (SMEs) have become exposed to debt-related stress.

The average bad debt amongst UK SMEs has jumped 61% – from £10,329 in Spring 2022, to £16,641. Currently, around 1.5 million – or 27% – of SMEs are struggling with this issue.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

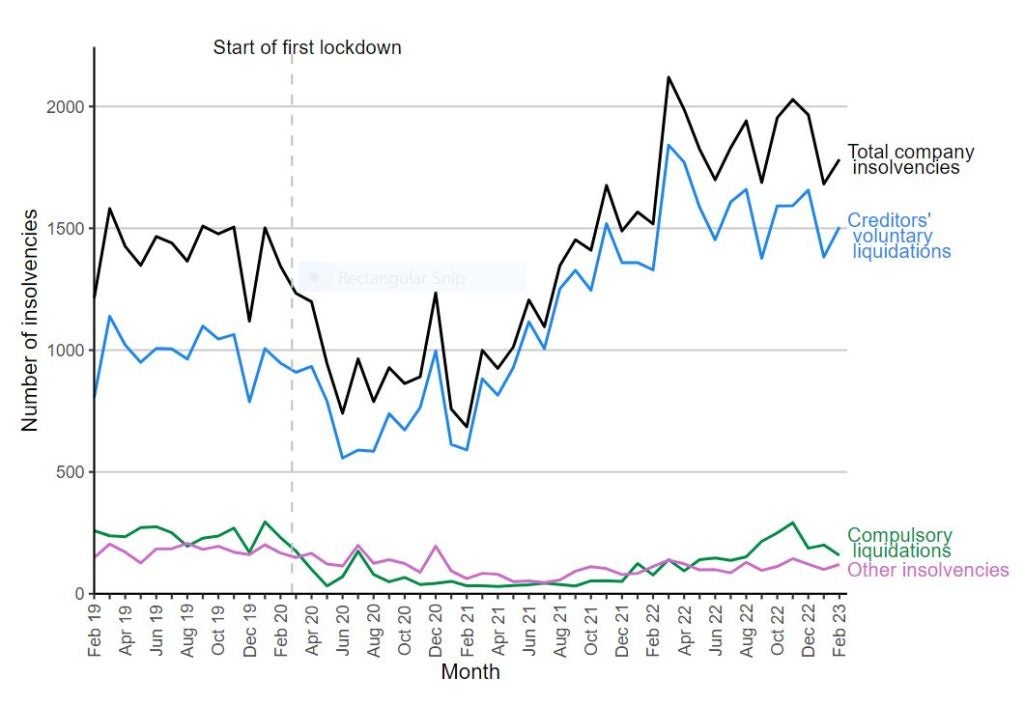

Combined with official statistics showing insolvencies in February jumped 17% when compared to the same time last year, data from BFS’s latest SME Confidence Tracker has exposed the fragility of Britain’s 5.5 million SMEs.

The number of registered company insolvencies in February 2023 was higher than in the same month last year, driven by higher numbers of Creditors’ Voluntary Liquidations (CVLs) and compulsory liquidations.

BFS found that almost half (47%) of businesses surveyed have seen at least one business customer cease to trade in the last six months alone, and a quarter (25%) have seen three or more customers become insolvent.

Derek Ryan, UK managing director of Bibby Financial Services said: “Rising insolvencies are causing huge ripple effects throughout supply chains across the country, leading to greater levels of bad debt for small and medium-sized businesses. Combined with the rising cost of borrowing, this presents a significant and very real threat to the survival of many SMEs today. It’s more important than ever that businesses shore up their credit control processes and look for ways to protect themselves against insolvency in their supply chains.”

Six in 10 businesses (60%) say it’s taking longer for customers to pay their invoices in full compared to a year ago, and 29% – equivalent to around 1.6 million – are worried about how long it’s taking for invoices to be paid. Today, SMEs each have an average £68,413 owed to them in unpaid invoices, stifling growth at a time when the Government is trying to drive economic prosperity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataToday’s environment is also making it harder for businesses to access the finance they need to continue operating, let alone grow. Three in five (59%) businesses surveyed say it’s harder to secure a loan today than during the pandemic and one in ten (11%) say they have struggled to secure finance for their business in the last six months. Meanwhile, nearly four in ten (39%) are worried they won’t be able to pay back loans if interest rates continue to rise.

Bibby’s Ryan said: “We may have narrowly avoided recession, but economic conditions remain incredibly volatile, especially for SMEs. Not only are SMEs grappling with the perennial issue of late payment and rising levels of bad debt, but they are also struggling to access the finance they need to operate day-to-day.

“More than ever, SMEs need to be able to access the funding they need to operate from a variety of sources. We would encourage the Government to relaunch the Bank Referral Scheme to boost SME funding at this pivotal time in the UK’s economic recovery.”

Spring Budget 2023 fails to impress motor finance professionals