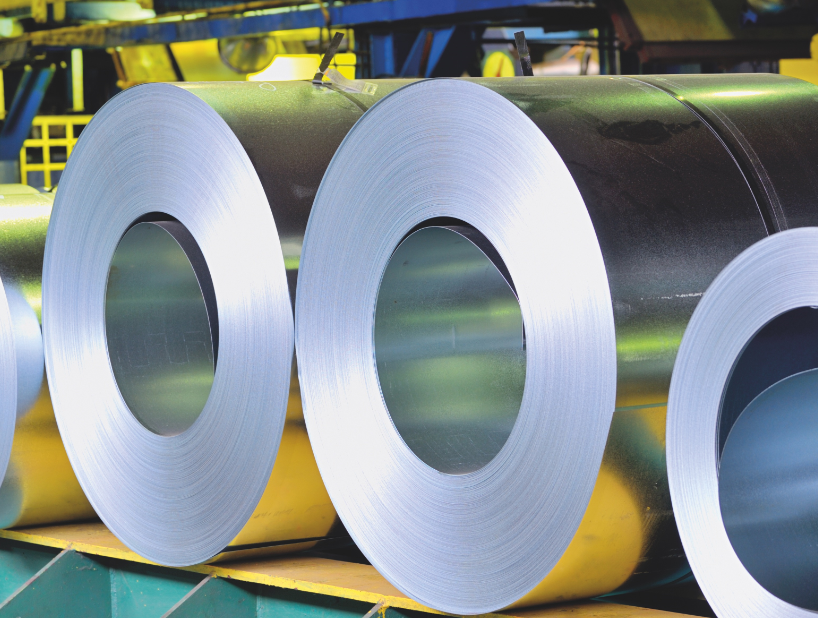

Arbuthnot Commercial ABL has funded the Management Buy In (MBI) of Bury‐based Bornmore Metals, a long-established non‐ferrous metals stockholder.

The deal was for an undisclosed sum. The transaction sees incoming managing director and investor Ian Griffiths acquire 100% of the shareholding of the business and provides a platform for Griffiths to bolster the business’ regional presence and expand its product range.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Ian Griffiths, managing director of Bornmore Metals, said: “My very first order in my first job was from Bornmore Metals, so I have known the business for a long time. I was approached by the vendor’s agents and saw an excellent opportunity to acquire the business. Our advisors recommended Arbuthnot Commercial ABL to fund both the MBI and to provide additional working capital in order to maintain the company’s growth and accelerate the pace.

“With Arbuthnot Commercial ABL, I feel we have a partner, not just a bank. They are there whenever we need them and are very straightforward to work with. We have ambitious plans to double our revenues in three to five years with their support and have an opportunity not only to lead but also to dominate our market.”

Arbuthnot Banking Group has achieved a profit before tax for 2018 of £6.8m, compared to the 2017 figure of £2.5m profit.

Arbuthnot’s Asset Based Lending (ABL) division commenced trading in May 2018, and has already issued facilities to the value of £43m and has drawn balances of £25m. In January ABL issued a further £29m of facilities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn March this year Arbuthnot Bank has agreed a £10m (€11.7m) asset finance based deal with VNA Trucks.

In 2017 Arbuthnot Latham completed its acquisition of Renaissance Asset Finance after securing regulatory approval.

First reported at the end of December 2016, Arbuthnot paid the consideration in four stages in cash from its current resources, with the first paid at completion and equal to RAF’s net assets at the time. As of 30th November 2016, RAF had customer assets of £68m (€80.6m) and net assets of £1.6m.