A $30bn (£21.6bn) bid by Irish aircraft leasing company AerCap for General Electric’s aircraft leasing business was unconditionally approved by EU antitrust regulators this week.

European Union regulators said that the combination of General Electric Capital Aviation Services (Gecas) and AerCap raised no competition concerns, saying the transaction is “unlikely to give rise to serious competition concerns in the markets for aircraft and aircraft engine leasing.”

The deal signals ongoing consolidation in the aviation leasing market that comes in the current phase of the Covid pandemic and is expected to continue.

Aviation leasing: AerCap

Given that GE is an aircraft engine manufacturer, the EU also considered this aspect and concluded the US firm was unlikely to use its minority shareholding in AerCap to affect competition for aircraft engines, aircraft leasing, or engine leasing.

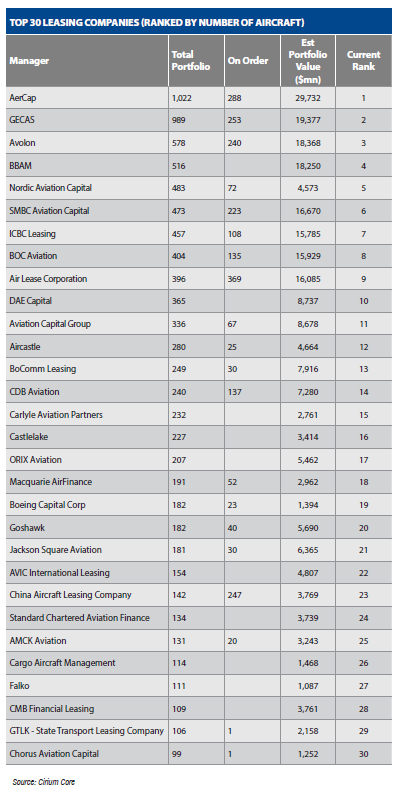

AerCap and Gecas are the world’s top two aircraft lessors by aircraft number and value, with approximately 2,000 planes between them and an estimated $49,109m in combined portfolio value, according to KPMG.

Route to Recovery: the Aviation Industry Leasing Leaders Report 2021, KPMG & Aviation Economics

Under the terms of the deal, AerCap will buy Gecas — including its stake in Shannon Engine Support, the Irish lessor of aircraft engines it jointly controls with France’s Safran Aircraft Engines — for $24bn in cash and $1bn in the form of AerCap notes and cash.

Additionally, AerCap will issue 115m new shares to GE, making it the largest shareholder with a 46 per cent stake in the combined leasing company. GE will also nominate two directors to the AerCap board. AerCap shareholders approved the deal in May. The deal remains subject to regulatory review in 20 countries. GE said the US Department of Justice concluded its review in June.