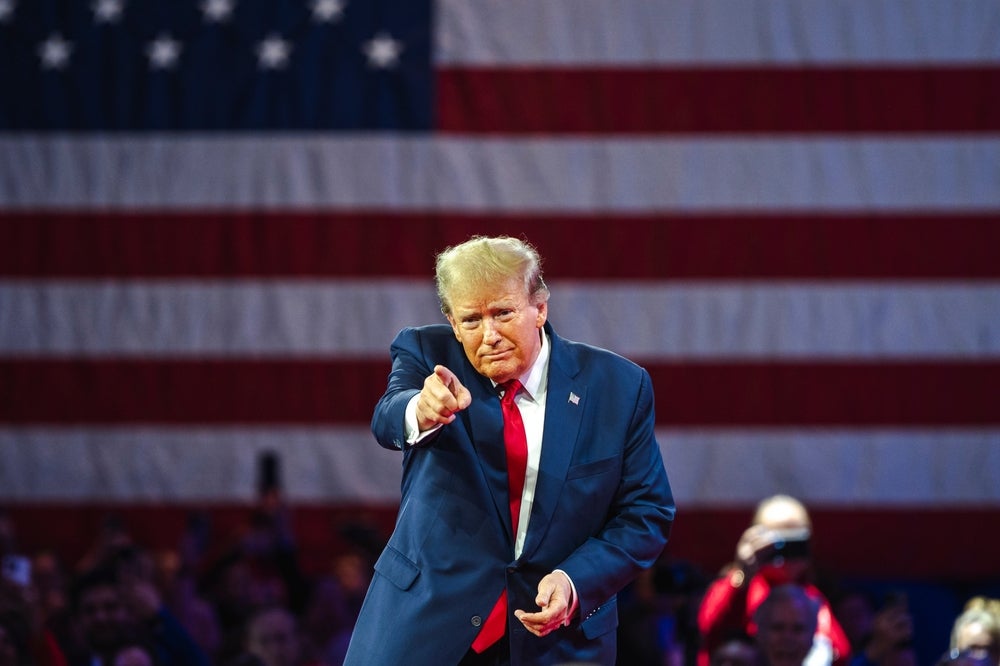

With Donald Trump poised to return to the White House, businesses on both sides of the Atlantic are evaluating how his administration’s policies could affect equipment leasing and financing.

Trump’s previous term was marked by tax cuts, deregulation, and an aggressive approach to trade — all of which had substantial impacts on capital-intensive industries. A second term could bring both opportunities and risks for the equipment finance sector, which is essential for industries ranging from manufacturing and construction to energy and healthcare.

Incentives for leasing?

Trump’s 2017 Tax Cuts and Jobs Act (TCJA) significantly lowered corporate tax rates and allowed businesses to expense capital investments, a provision particularly beneficial to those acquiring or leasing new equipment. If similar tax cuts and incentives are reintroduced, they could create favourable conditions for equipment leasing in the US. Lower tax rates can enhance cash flow, making it easier for companies to enter into long-term leasing agreements, while tax deductions for capital investments could drive demand for leased equipment as companies seek to maximise these benefits.

In Europe, however, the impact of US tax policies is less direct. European companies may still benefit indirectly if US-based suppliers, with improved cash flow and capacity, boost production and lower prices. But if Trump’s tax approach sparks new rounds of international competition on corporate tax rates, European markets could experience changes in capital investment dynamics, potentially affecting the leasing market’s attractiveness.

Deregulation and lower compliance costs

One of Trump’s hallmarks is his commitment to reducing regulatory burdens for businesses. Deregulation could lower compliance costs for equipment-intensive industries, including energy, construction, and manufacturing, potentially freeing up resources for equipment leasing. This reduced regulatory oversight might be particularly beneficial for smaller firms, which often face high compliance costs that discourage major investments.

In Europe, by contrast, regulatory standards tend to be stricter and are often tied to environmental and safety goals. If Trump’s policies favour deregulation over environmental protection, US businesses might gain a short-term cost advantage over European firms in high-equipment industries. However, companies with transatlantic operations could face additional challenges as they navigate these divergent regulatory landscapes, potentially affecting the demand for leased equipment depending on where compliance is more financially feasible.

Boosting energy and manufacturing

Trump’s economic policies are likely to focus on revitalising US manufacturing and boosting domestic energy production, particularly in fossil fuels. This emphasis could stimulate demand for equipment leasing in these sectors, which depend on heavy machinery and capital-intensive assets. A stronger economy often spurs investment, and if manufacturing and energy production expand, equipment financing companies may see increased demand from firms looking to lease the tools necessary to scale up their operations.

However, Trump’s economic strategy may not come without volatility. The prioritisation of energy production, for example, could attract criticism and potential market hesitations, given the global shift towards renewable energy and sustainability commitments. For European equipment financiers, this creates a complex landscape. While demand for US fossil-fuel equipment may grow, Europe’s green energy priorities could limit the leasing demand for non-renewable-focused equipment, leading European financiers to pivot further towards renewable energy leasing to remain competitive.

Tariffs and global supply chains

Trump’s stance on trade could present mixed outcomes for equipment financing, particularly if he resumes his aggressive approach towards tariffs. During his first term, tariffs on imported goods, particularly from China, increased costs for businesses reliant on foreign equipment and materials. If similar tariffs are reintroduced, businesses could face rising prices for equipment, which may dampen leasing demand or increase leasing costs, as higher prices are passed on to lessees.

In Europe, which often depends on equipment imported from the US and China, Trump’s trade policies could create additional costs and logistical challenges. This could lead to increased interest in domestic leasing options as European companies look to avoid the added expense of US or Chinese imports. Alternatively, the reopening of trade negotiations under Trump could lead to favourable terms for some sectors, which may lower costs for certain types of equipment and make leasing more attractive.

Potential for a mixed Impact

Ultimately, Trump’s potential return to office presents both opportunities and risks for the equipment leasing industry. In the US, favourable tax policies and deregulation could make equipment leasing more attractive, supporting business growth across capital-intensive sectors. On the other hand, the uncertainty surrounding trade policies and economic strategies could increase costs and create volatility, complicating leasing decisions for businesses that rely on stable financing conditions.

For European financiers and businesses, the implications of a Trump presidency would be felt through indirect channels. Regulatory divergence, trade costs, and varying economic policies could impact leasing attractiveness and demand, particularly in sectors sensitive to shifts in energy and environmental policy. A Trump administration may create a competitive landscape that benefits equipment leasing in certain US industries while pushing European markets to further align their leasing focus with renewable and sustainable technologies.