Christopher Granville, Managing Director of Global Political Research at TS Lombard, has raised questions about the potential impact of a Trump presidency on foreign direct investment (FDI) flows, which could have implications for green energy financing.

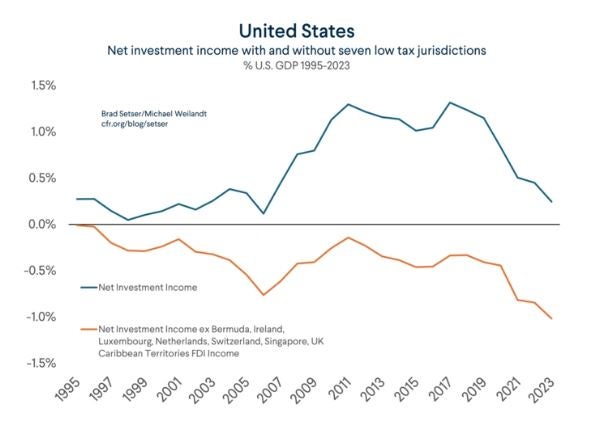

On the likelihood of extended corporate tax cuts, Granville noted that Trump’s tax policies could incentivise large American firms to repatriate profits currently held in tax havens abroad, potentially lowering incentives for outbound FDI.

“A cornerstone of Trump’s programme is the extension of the tax cuts enacted during his first presidential term (in 2017),” Granville explained. He suggested that Trump’s proposed reduction of corporate profit tax — potentially “as low as 15%” — aims to bring capital back to the US by reducing the incentive for US firms to book profits overseas. This would likely impact tax havens such as Ireland, where US tech companies record substantial revenues from international operations.

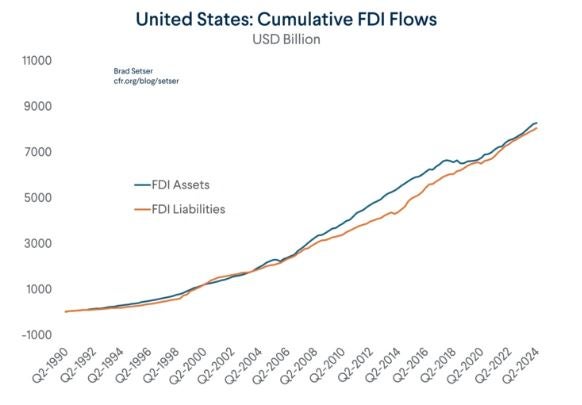

Granville’s analysis focuses exclusively on FDI flows. Historically, FDI “inflows” (investment into the US) and “outflows” (US investment abroad) have remained balanced, he observed, but Trump’s tax cuts may disrupt this balance in favour of increased domestic investment. Granville suggested that a tax rate cut could shift the FDI balance “toward inward vs outbound FDI,” encouraging US-based reinvestment.

If enacted, this shift could indirectly affect equipment financing and green energy investment, according to one interpretation from Granville’s findings. With a reduced incentive for outbound FDI, investment in international green energy projects could decline. Domestically, lower corporate tax revenues could mean less federal support for green infrastructure, especially if the Trump administration maintains its traditional energy focus over renewables.

The long-term effects of this shift remain uncertain, but Granville’s analysis suggests that the next phase of US tax policy could shape green energy financing dynamics, both within the US and internationally.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

How a Trump Presidency could reshape equipment financing in the US and Europe