French banks are projected to experience slower profitability growth compared to their European counterparts until late 2025, according to Fitch Ratings.

This delay is attributed to structurally slow loan repricing and significantly higher deposit costs following the interest rate hikes in 2022-2023, compounded by intense pricing competition.

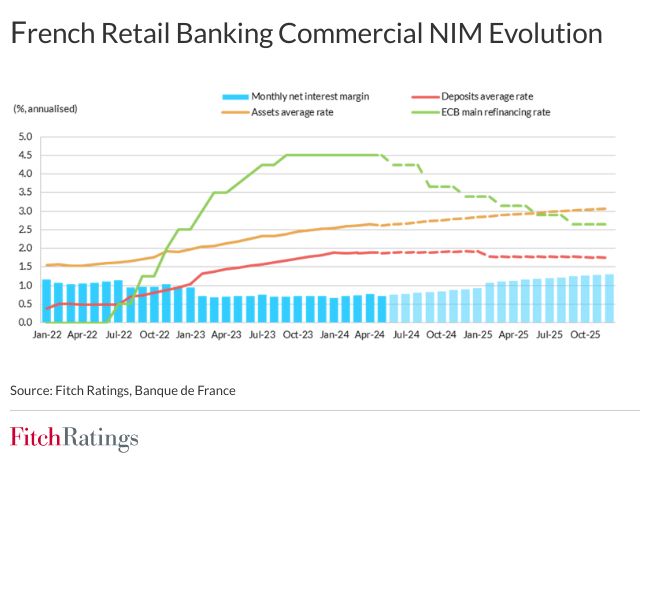

The net interest margins (NIMs) of French banks are not expected to fully benefit from higher interest rates until late 2025, extending beyond Fitch’s original forecast by several months. This is primarily due to more intense pricing competition on deposits than initially anticipated.

However, Fitch expects that business diversification, a gradual recovery in French retail banking, and effective cost management will support a gradual performance improvement through 2025.

In the first half of 2024, French banks showed adequate performance but continued to lag behind most of their European peers. The sector’s operating profit/risk-weighted assets (RWA) ratio remained slightly below 2%, compared to at least 3% in most other major European markets.

Consolidated revenue for the six leading French banking groups — BNP Paribas (BNPP), Crédit Agricole, Société Générale, BPCE, La Banque Postale (LBP), and Crédit Mutuel Alliance Fédérale (CMAF) — increased by an average of 1.8% year-on-year (yoy) in the first half of 2024, while costs decreased by about 1% mainly due to lower regulatory charges.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, underlying cost inflation still outpaces revenue trends at some banks. Operating profit/RWA showed mixed trends, with slight yoy improvement at BNPP and stable or slightly weaker performance at others. All banks reported quarterly improvements in the second quarter of 2024, and Fitch expects their full-year performance to be stronger than in 2023, except for LBP.

In French retail banking, a slow recovery in NIMs was observed in the second quarter of 2024. Most leading banks reported quarter-on-quarter improvements in net interest income (NII).

However, the recovery remains fragile and slower than expected, primarily due to fierce price competition on deposits. The shift to term deposits and regulated savings from sight deposits has weighed on NIMs compared to other Western European markets.

Additionally, competitive pressures led to significant declines in new loan rates during the first half of 2024 compared to the end of 2023, further delaying NIM recovery, while funding costs have not yet decreased significantly.

Fitch anticipates that French retail NII in the second half of 2024 will be higher than in the second half of 2023, but a full-year NII increase is unlikely until 2025. A more noticeable turnaround in NII should emerge in the first half of 2025, provided interest rates decline gradually. Fitch expects NII to recover to 2022 levels by the end of 2025, unless a significant drop in funding costs or a substantial boost in credit volumes accelerates the recovery.

Despite the sluggish NIM recovery, French retail revenue (NII, commissions, and other income) is expected to achieve solid single-digit growth in 2025, barring adverse changes in funding costs, loan volumes, or the French economic and political environment. Key factors for revenue growth include a potential reduction in the Livret A rate, lower costs for new term deposits, and accelerated loan originations.

The banks’ first half 2024 revenue benefited from diversification, which mitigated what would otherwise have been weak results. Positive contributions came from corporate and investment banking, insurance, and wealth management. The sector also benefited from a reduction in Single Resolution Fund contributions, although cooperative banks faced higher staff and IT investment costs.

Loan impairment charges rose slightly in the first half of 2024, with CMAF experiencing the most significant increase. Impaired loan ratios increased modestly, consistent with Fitch’s forecast of a 3% impaired loans ratio for the sector by the end of 2024.

Capital ratios remained stable, with banks having sufficient headroom to absorb the implementation of Basel III end-game rules. Fitch expects the operating profit/RWA ratio for French banks to slightly increase towards 2% on average for 2024, supported by generally strong results in diversified segments, and to continue improving in 2025.