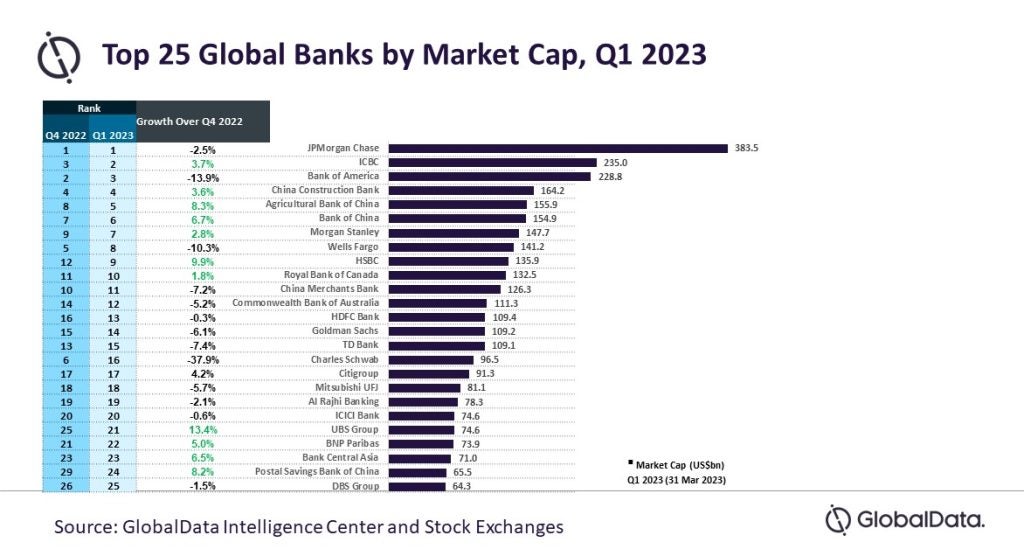

The aggregate market capitalisation (MCap) of the top 25 global banks fell by 2.5% to $3.2 trillion quarter-on-quarter during the first quarter that ended on 31 March 2023, according to GlobalData, a data analytics company.

These findings reflect that the markets are still volatile owing to rising global inflation coupled with the US regional banking crisis. However, the global banking sector witnessed little impact from the regional banking crisis in the US, the research company said.

Murthy Grandhi, a company profiles analyst at GlobalData, said: “Banks that gained the most during Q1 included UBS Group, HSBC, and Agricultural Bank of China. Postal Savings Bank of China, Bank of China, and Bank Central Asia. Charles Schwab, Bank of America, and Wells Fargo witnessed a drop in market capitalisation.”

In the US, Charles Schwab, Bank of America and Wells Fargo lost over 10% in market capitalization during Q1 2023.

UBS and HSBC

UBS Group’s positive 2022 results coupled with the acquisition of beleaguered Credit Suisse fuelled the share price, which resulted in a 13.4% rise in its MCap.

Strong growth in revenues in FY2022 for HSBC Holdings, supported by the performance in all divisions and cost discipline, coupled with a reshaped portfolio including exits from US mass market retail, the planned sale of France retail, Canada banking business, and Russia and Greece operations, resulted in a 9.9% increase in its Mcap to US$135.9 billion.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBCA

Positive FY2022 results pushed up the share prices of Bank Central Asia (BCA), leading to a 6.5% rise in MCap. The Indonesia-based bank reported an 11.5% increase in its net revenue of Indonesian Rupiah 87.5 trillion, supported by a healthy current account and saving account balance and loan portfolio.

Murthy Grandhi said: “Charles Schwab’s MCap fell by 37.9% majorly due to negative investor sentiment as its massive bond holdings of longer maturities created fear of another crisis despite enough liquidity in the form of US$40 billion of cash and equivalents and a low loan-to-deposit ratio. Bank of America and Wells Fargo faced a MCap decline of 13.9% and 10.3%, respectively, due to selloffs owing to the regional banking crisis.”

China’s Big Four

China’s Big Four banks—ICBC, Bank of China, Agricultural Bank of China, and China Construction Bank – gained between 4-8% in MCap owing to less exposure to the global banking industry coupled with a recovery in lending from the Covid-19 pandemic.

Grandhi said: “Challenges in the global banking sector may take the form of higher interest rates, inflation, and slower economic growth in the coming quarters of 2023. Net interest margin expansion will be smaller than previously anticipated, and volumes will be lower due to tighter credit conditions.”

GlobalData is the parent company of Verdict a publishing stable that includes Leasing Life.